⬆️ FL homes appreciating, TGH's impact, & promising real estate data for 2024

⌛ The age to own a home in Florida is increasing

Driving the news: A comprehensive study reveals a significant shift in the age at which most Floridians are becoming homeowners.

As reported by Axios' Megan Rose Dickey and Brianna Crane, the current age has risen to 42, marking a notable increase over past decades.

Details: This finding comes from a recent study conducted by the University of California, Berkeley. It underscores a trend that sees the age of first-time homeownership climbing steadily.

Why it matters: The upward shift in homeownership age is a clear indicator of the increasing difficulty of acquiring property, particularly for younger generations.

This trend has broad implications for financial stability and wealth accumulation among younger adults.

By the numbers: To put this in perspective, back in 1980, the majority of Floridians achieved homeownership by the age of 30.

This age increased to 34 by the year 2000, demonstrating a consistent upward trend over the years.

What’s happening: The root of this shift can be traced back to economic factors. Median home values in the U.S. have nearly doubled over the last decade.

However, household incomes have not kept pace, growing only about 13.5% during the same period. This disparity between home prices and income growth is a key factor in delaying homeownership.

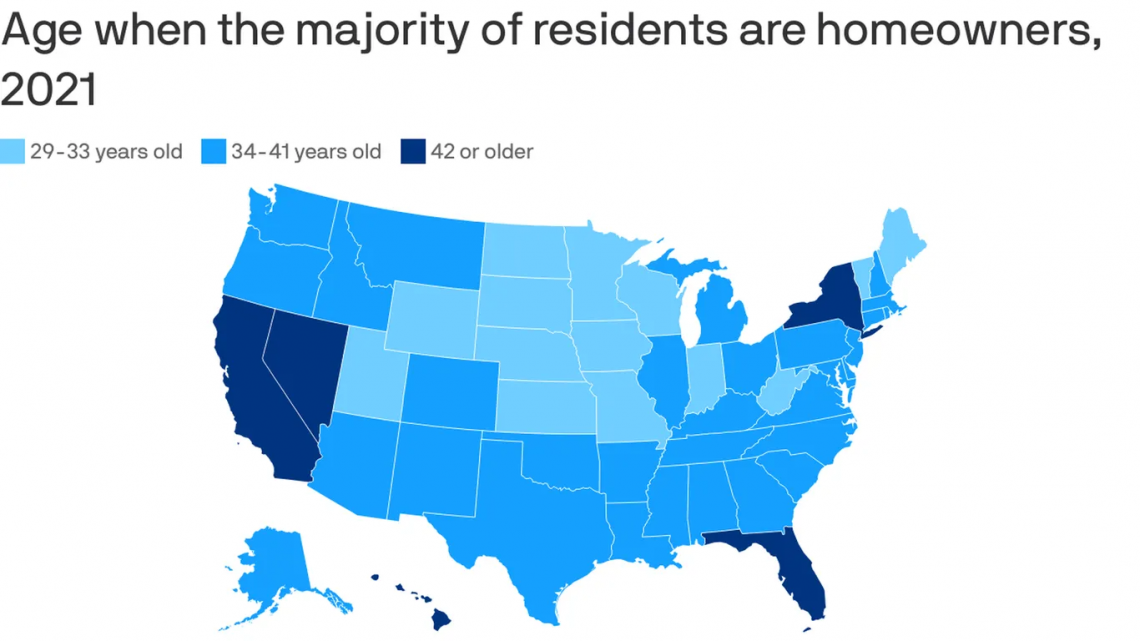

The big picture: This phenomenon is not unique to Florida. Across the United States, the age of homeowners is rising. The study shows variations across states:

- In California, the age for the majority of people to own a home has reached 49 years, the highest in the country.

- Iowa presents a contrasting scenario with the youngest average age of homeowners at 29, showing the least deviation from 1980 figures.

- Interestingly, Alaska is an outlier where the age of homeownership is actually decreasing, with most Alaskans owning a home by 35 in 2021, down from 36 in 2000.

The bottom line: The trend of rising ages for first-time homeownership in Florida and across the U.S. reflects deeper economic challenges.

It highlights the growing gap between real estate prices and income growth, posing significant hurdles for younger individuals and families aspiring to own homes.

🏥 Innovating Patient Care: How TGH is Redefining Healthcare in Florida

Driving the news: Last year, a study involving Harvard Medical School and other prestigious institutions revealed that community medical centers affiliated with academic health systems offer superior patient outcomes.

Details: Tampa General Hospital (TGH), in collaboration with the USF Health Morsani College of Medicine, exemplifies this trend.

This partnership is transforming TGH into a Florida-wide center of excellence, extending its reach through alliances with local hospitals and physicians.

Why it matters: TGH's approach emphasizes enhanced access to complex care and clinical trials, aiming to boost patient outcomes statewide.

The big picture: TGH's rise as a center of excellence stems from two key factors. Firstly, its pioneering role in COVID-19 treatment research and adaptability during the pandemic.

Secondly, its commitment to serving underserved communities, ensuring care regardless of financial or insurance status.

By the numbers: The hospital's efforts have not gone unnoticed, attracting attention and interest from numerous physicians' groups across Florida's East Coast, looking to join TGH's expanding network.

Between the lines: TGH's dual role as a safety net hospital and an independent, non-profit entity sets it apart, focusing on patient care over profitability.

What’s next: Through state-wide partnerships, TGH is broadening its reach and services as an academic health system, catering to a diverse patient population while maintaining high standards as a teaching and research hospital.

The bottom line: TGH's expansive infrastructure, access to cutting-edge clinical trials, and adaptable approach have positioned it as not just a local but a state-wide healthcare leader, particularly in times of major health crises like the COVID-19 pandemic.

📈 Case-shiller home price index marks "strongest national growth rate since 2022"

Driving the news: Data has been released that shows a significant trend in the housing market.

In October, we saw the strongest national growth rate in home prices since 2022.

Details: The S&P Dow Jones Indices recently released this information as part of their regular updates on home prices across the U.S. for October 2023.

This increase is happening even though it's getting more expensive to borrow money for a home, as mortgage rates are going up.

Why it matters: The fact that home prices are still rising, even with the ups and downs in the economy, shows that the real estate market is strong and steady.

This affects not just people who own homes or are looking to buy, but also investors and the larger economy. It plays a big role in how people make decisions about housing.

The big picture: Looking at different cities, Detroit is seeing the biggest growth with an 8.1% increase in home prices. San Diego and New York are also seeing significant rises, at 7.2% and 7.1% respectively.

On the other hand, Portland is the only city where prices have gone down, with a 0.6% drop from last year.

Between the lines: The variation in growth rates across cities highlights regional economic disparities and differing real estate market dynamics.

What’s next: Keeping an eye on these trends is important. They can give us clues about where the economy might be headed and help shape future policies and strategies in the housing market.

The bottom line: The sustained growth in home prices, despite challenges like rising mortgage rates, showcases the ongoing strength and complexity of the U.S. housing market.

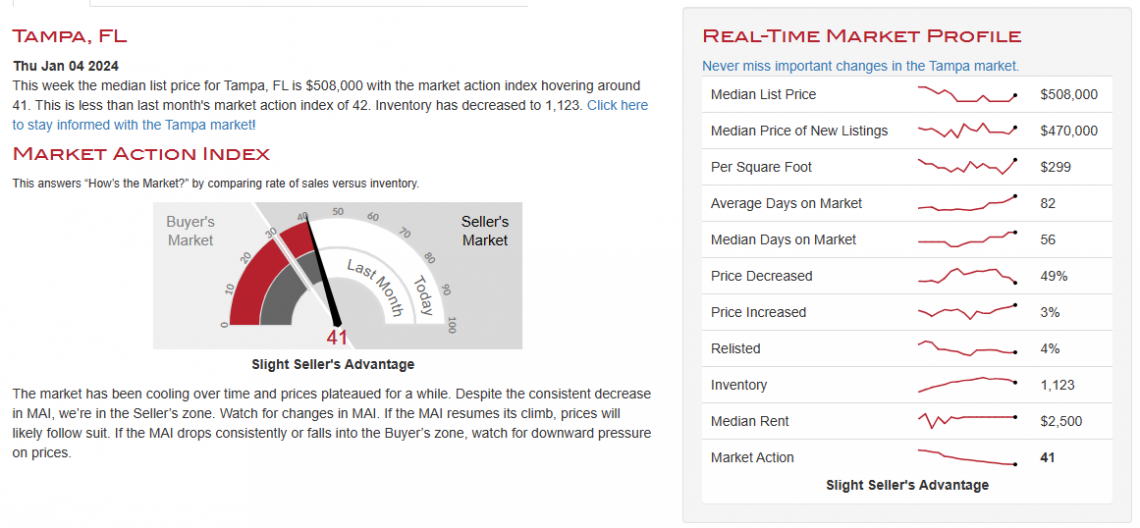

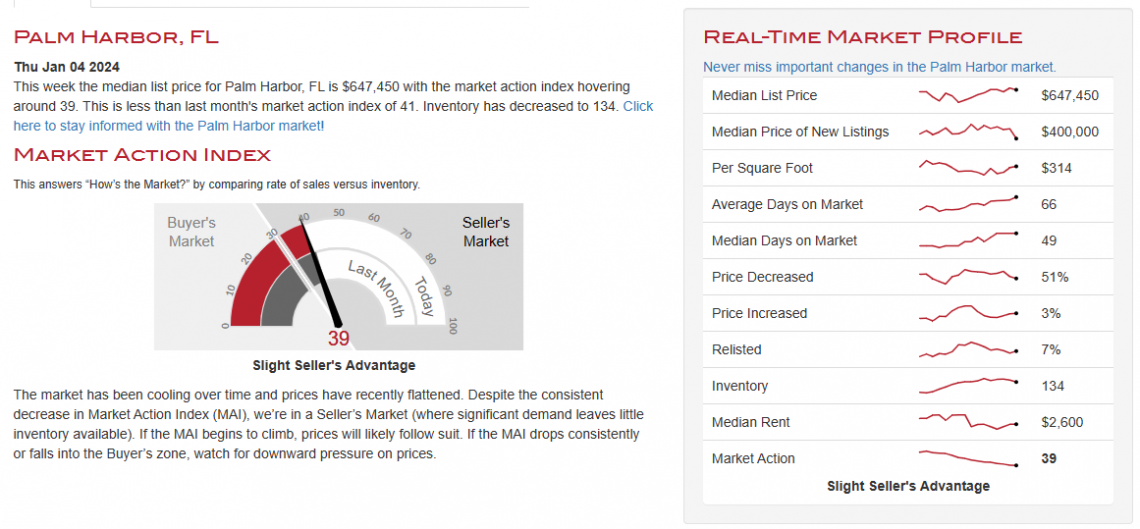

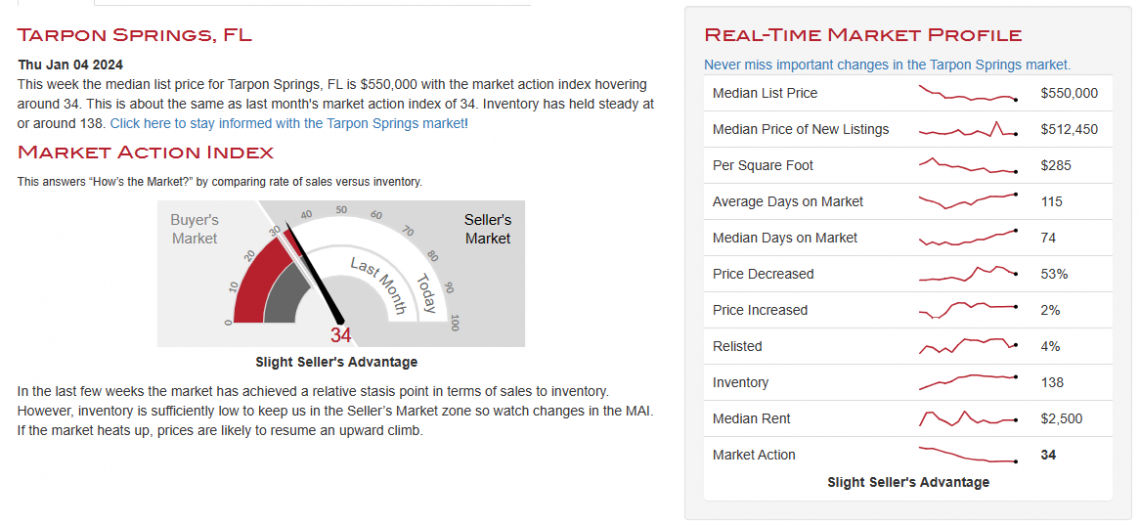

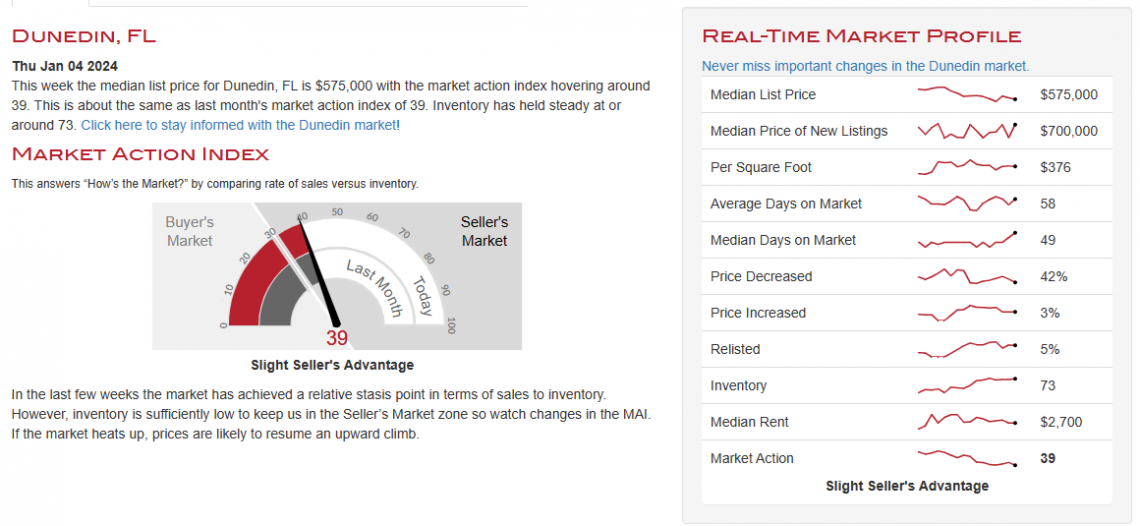

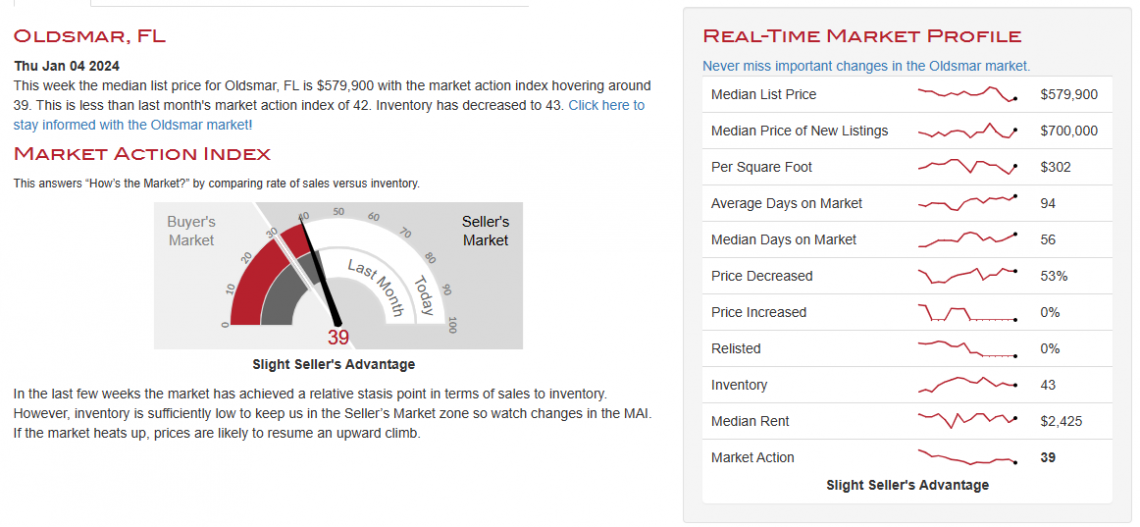

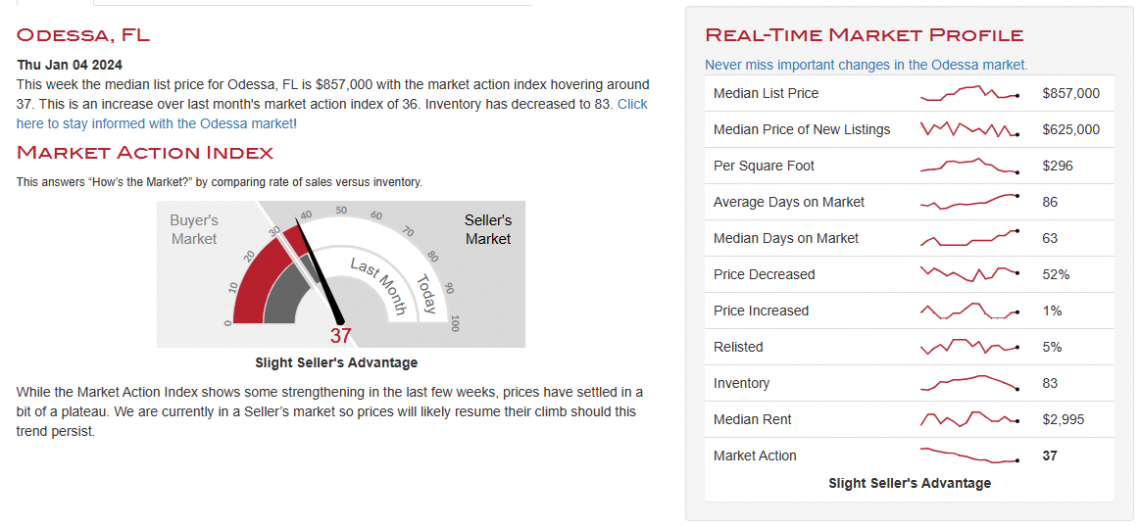

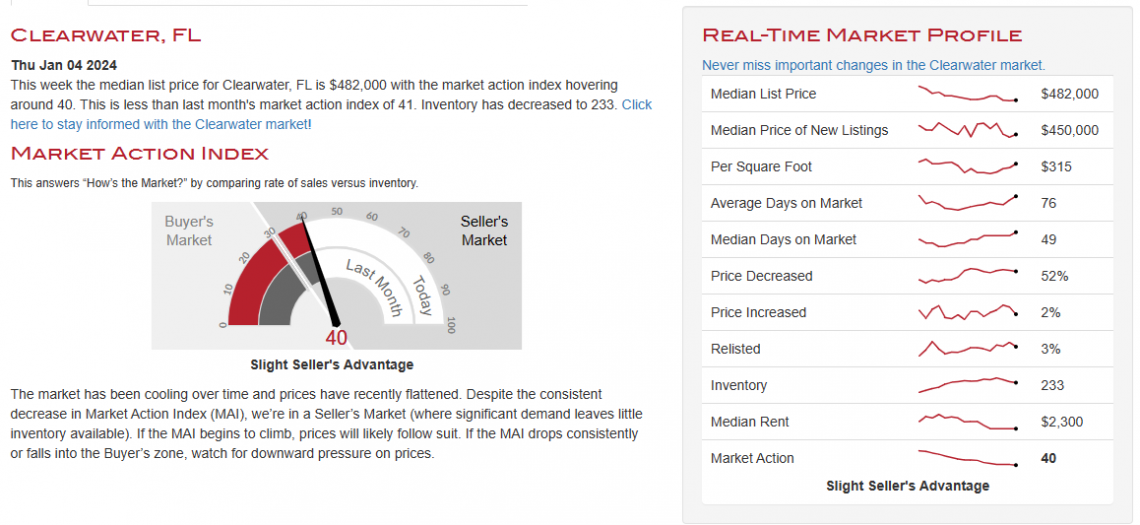

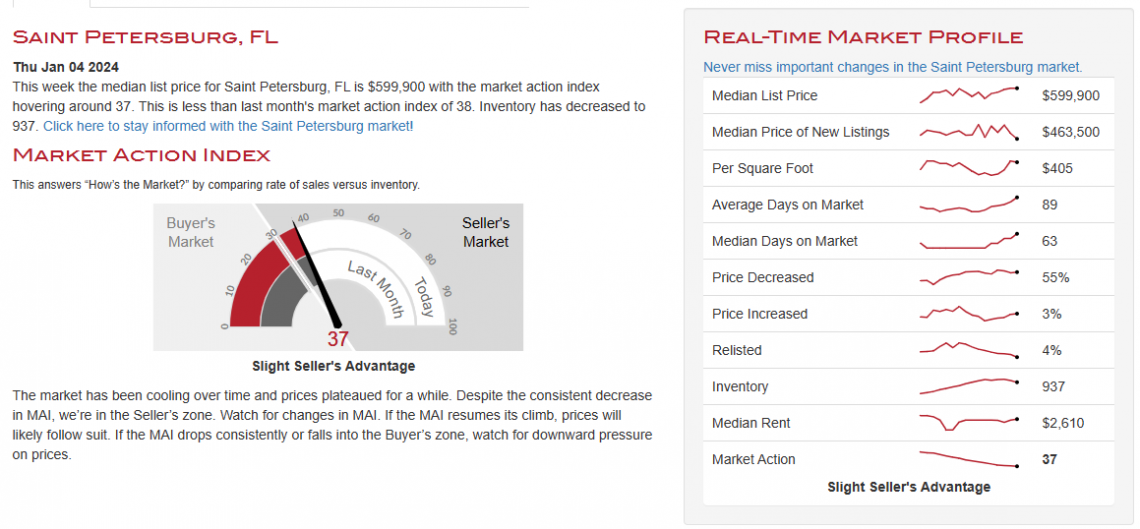

📊 Our Current Local Market Numbers

The Pinellas and Tampa Bay markets are showing signs of cooling off after a period of rapid price appreciation.

- Median Sale Price: $431,000 (November 2023)

- Tampa's median sale price is 6% higher than the national average

- Average Days on Market: 27

While the Tampa/Pinellas area real estate market is still witnessing year-over-year growth in median sale prices, the pace of appreciation has moderated.

Homes are taking slightly longer to sell compared to last year, yet inventory levels, though still low, are showing signs of improvement. Sales volume remains robust, although it has eased from the peak levels observed earlier this year.

Outlook:

- The Tampa/Pinellas area real estate market is expected to remain strong in the near term.

- However, the rate of price appreciation is likely to slow further.

- Homes are expected to spend more time on the market.

- Inventory levels are expected to continue to increase.

- Sales volume is expected to remain stable.

I'm happy to help you create a home-buying strategy that will allow you to navigate the current market.

If you ever have questions, don’t hesitate to ask.

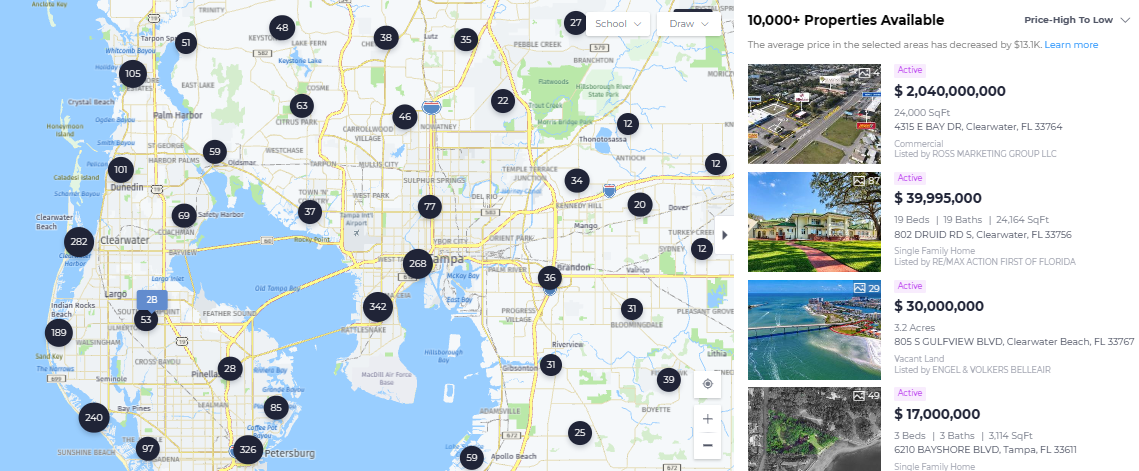

🏠 Find Available Homes Today

- Available Homes in Palm Harbor

- Available Homes in Tarpon Springs

- Available Homes in East Lake

- Available Homes in Odessa

- Available Homes in Westchase

- Available Homes in Oldsmar

- Available Homes in Safety Harbor

- Available Homes in Dunedin

- Available Homes in Clearwater

- Available Homes on the Beaches or Intercoastal

- Available Homes on a Golf Course

- All Available Homes

📰 In Other News:

- That’s all for today, We hope you have an amazing week!

If there’s ever anything you need:

- Custom market or home value report.

- Home Services list for a reliable contractor or services professional.

- Feedback or a professional opinion on a home project or other needs of the home.

Just let us know! We’re here to help with all your home needs.

Talk soon,