🐠 Florida Aquarium sees 1M visitors, Port Tampa expands, & refinancing in 2024

🐬 Tampa's Florida Aquarium reaches one million visitors for the first time

Driving the news: The Florida Aquarium, a prominent feature of Tampa's Channel district, achieved a historic milestone last week by welcoming its one-millionth visitor of the year.

This record-breaking attendance is a first in the Aquarium's history.

Details: Celebrations erupted as the Aquarium President and CEO, Roger Germann, announced the Narankevicius family from Tampa as the landmark visitors.

The family was greeted with applause, a special button, a gift basket, a year-long membership, and various souvenirs.

Why it matters: This achievement highlights the Aquarium's growing appeal and its significant role in Tampa's cultural and tourism landscape.

The introduction of the MORPH’D gallery this summer has been instrumental in attracting a broader audience.

The big picture: The Aquarium is not just a tourist attraction but a key player in the urban development of Tampa's Channel district.

Discussions are ongoing about extending the Tampa Riverwalk to integrate more of the waterfront into the city’s urban fabric, reflecting a push for greater accessibility and engagement with the city's growing population.

By the numbers: The Florida Aquarium is ranked eighth nationally in size, with its tanks holding 500,000 gallons of water.

In contrast, the Georgia Aquarium, the largest in the U.S., boasts over 11 million gallons.

Between the lines: The Aquarium's success is not solely due to visitor numbers. Its conservation efforts, particularly in marine wildlife and habitat restoration, have been commendable.

Significant strides have been made in sea turtle and coral population recovery.

What’s next: Looking forward, the Aquarium is undergoing its largest expansion yet, a $40 million project slated for completion between late 2025 and early 2026.

This expansion is part of a broader $45 million fundraising initiative, recently boosted by a substantial donation from the Vinik Family Foundation.

The bottom line: The Florida Aquarium's milestone in visitor numbers, alongside its active role in conservation and community development, underlines its growing importance in Tampa's economy.

Its expansion and future projects promise to enhance its impact and reach in the coming years.

🚢 New berth for Titan America at Port Tampa Bay to move forward in 2024

Driving the news: The Hillsborough County City-County Planning Commission has greenlit a pivotal project at Port Tampa Bay.

This initiative, crucial for reducing cargo congestion, focuses on constructing a new berth (the area where a ship is docked and tied up) exclusively for Titan America, a leading cement and building materials producer.

Details: Port Tampa Bay has secured approval for a standard work permit to develop Berth 218. This development is set to alleviate the burden on Berth 219, currently a hub for cold storage products and building materials.

Berth 219, situated at Hookers Point's southern edge, will witness less pressure, enabling Titan America to operate independently while another vessel unloads at the adjacent berth.

Titan America currently transports 500,000 tons of product annually through Berth 219.

The new Berth 218 will be constructed using a steel sheet pile bulkhead and will involve over 50,000 cubic yards of imported fill.

Why it matters: This project is a strategic move to optimize port operations and manage the increasing cargo traffic effectively.

By creating a dedicated berth for Titan America, the port aims to streamline its logistics, enhancing efficiency and productivity.

Between the lines: This infrastructure enhancement is not expected to negatively impact navigation or the environment.

The proposed location has already been dredged to accommodate large vessels.

What’s next: The $19.5 million project, currently open for bids with a deadline of January 11, will be presented at the port board meeting in February 2024.

Construction is anticipated to start in March 2024, with an estimated completion time of 8-9 months.

The bottom line: Berth 218 symbolizes a significant step forward for Port Tampa Bay.

It aligns with the port's strategic plans to accommodate the expected increase in activities due to ongoing economic growth, as highlighted in the port's application to the planning commission.

🏠 Should you refinance your mortgage in 2024?

Driving the news: With fluctuating interest rates and economic shifts, homeowners are contemplating whether 2024 is the right time to refinance their mortgages.

This decision is particularly relevant for those who purchased homes at peak rates and are now facing potential benefits from a rate and term refinance.

Details: The mortgage landscape has been volatile, with historic lows in 2021 shifting to much higher rates. This scenario has profound implications for homeowners and the overall housing market, influencing decisions on homeownership and refinancing.

With potential rate cuts by the Federal Reserve in 2024, homeowners, especially recent buyers, might find refinancing advantageous.

When to consider refinancing: These are some scenarios where you should look at your loan and consider refinancing:

- Lower Interest Rates: Consider refinancing if mortgage rates have decreased significantly since you took out your original loan. A rule of thumb is to refinance when you can lower your interest rate by at least 0.75 to 1 percentage point.

- An increase in income: If you find yourself making more money, refinancing to a shorter-term loan, like switching from a 30-year to a 15-year mortgage, can save you money in the long run. This usually increases your monthly payments but significantly reduces the total interest paid over the life of the loan.

- Improved Credit Score: If your credit score has improved since you first secured your mortgage, you might qualify for a lower interest rate. Lenders offer better rates to borrowers with higher credit scores, as they pose a lower risk.

- Removing Mortgage Insurance: Refinancing can also help you eliminate the need for mortgage insurance. This is particularly relevant if you have built up sufficient equity in your home (typically 20% or more).

- Tapping into Home Equity: A cash-out refinance allows you to access the equity you've built up in your home, which can be used for various purposes like debt consolidation, home improvements, or other significant expenses.

You should always consider the closing costs of refinancing and calculate the break-even point — the time it takes for the monthly savings from the new mortgage to outweigh the refinancing costs. This analysis will help you determine if refinancing is financially worthwhile.

Why it matters: Refinancing can lead to significant financial benefits, such as lower monthly payments, faster mortgage payoff, and access to home equity.

For those who secured mortgages at higher rates, a reduction in interest rates could mean substantial savings and more manageable loan terms.

What’s next: Homeowners should closely monitor interest rates and economic indicators in 2024.

Those who purchased homes at higher rates should particularly consider refinancing if rates drop, ensuring they meet the criteria for substantial savings.

The bottom line: The decision to refinance a mortgage in 2024 hinges on a complex interplay of interest rates, individual financial situations, and market trends.

Homeowners should stay informed and consult with financial experts to determine the most beneficial course of action for their specific circumstances.

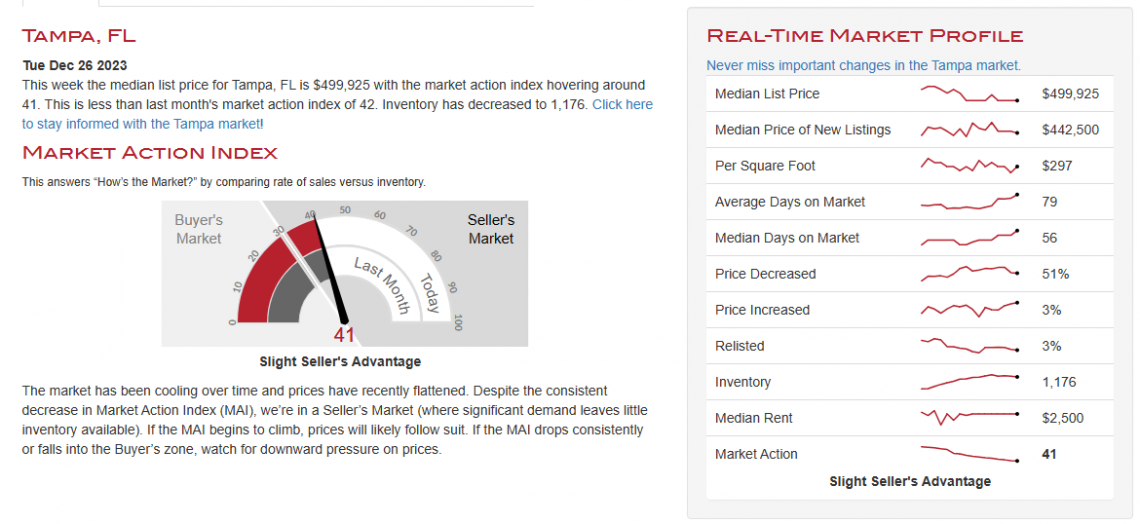

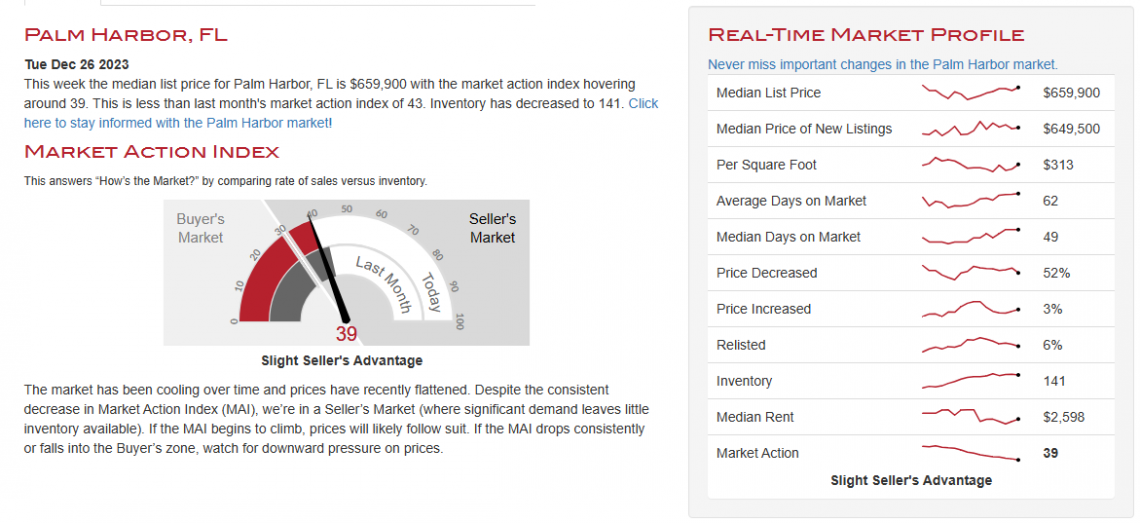

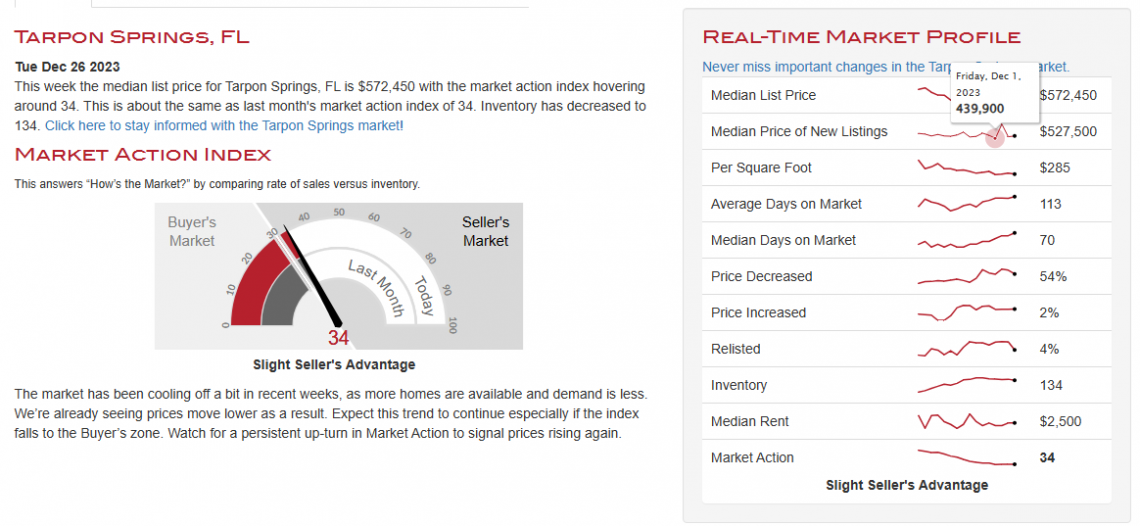

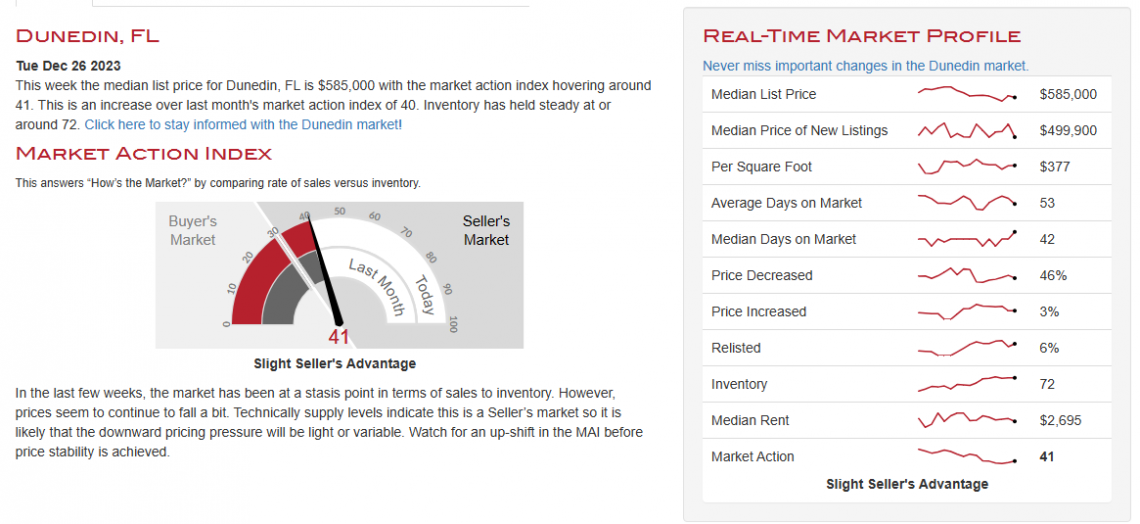

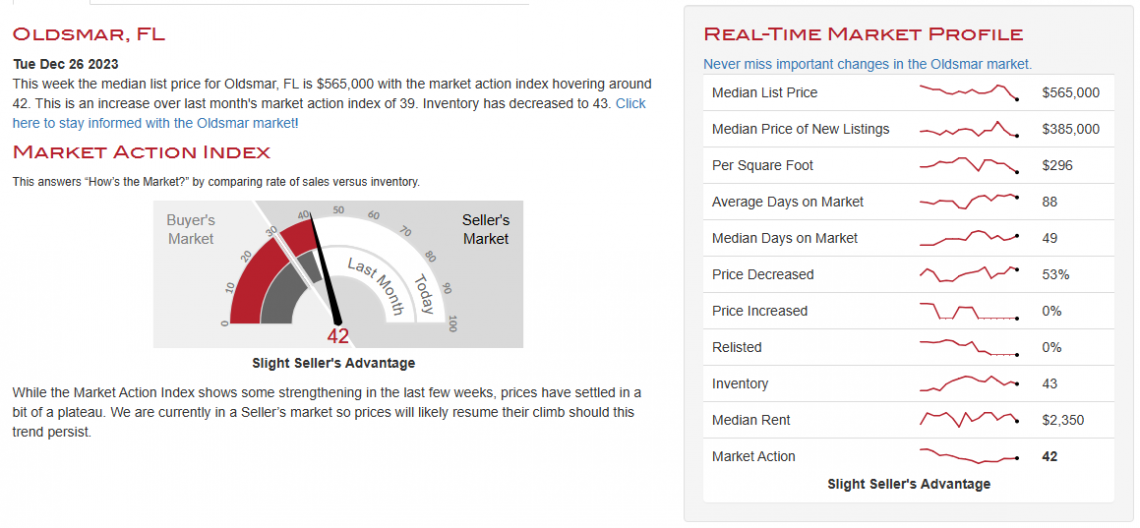

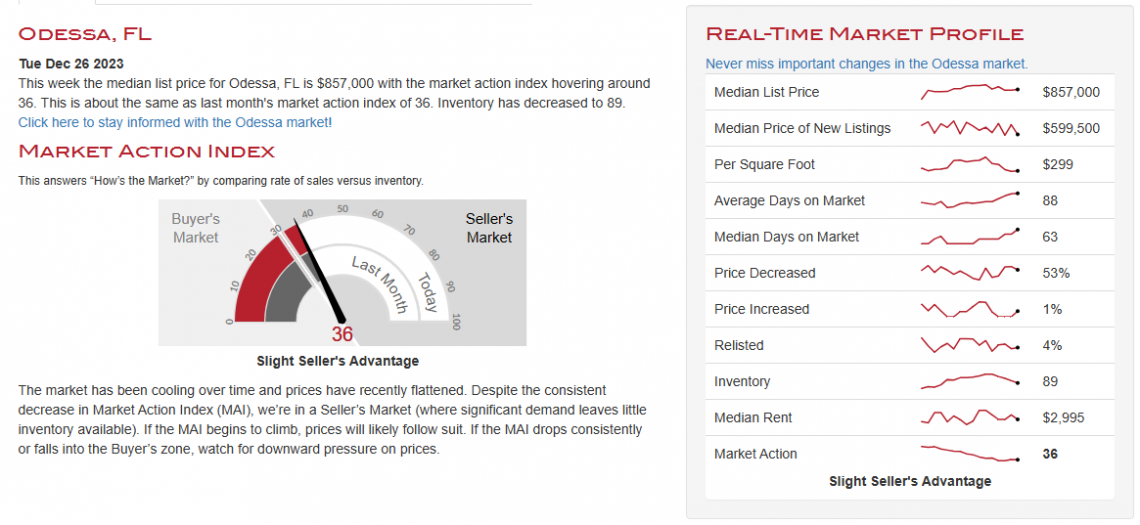

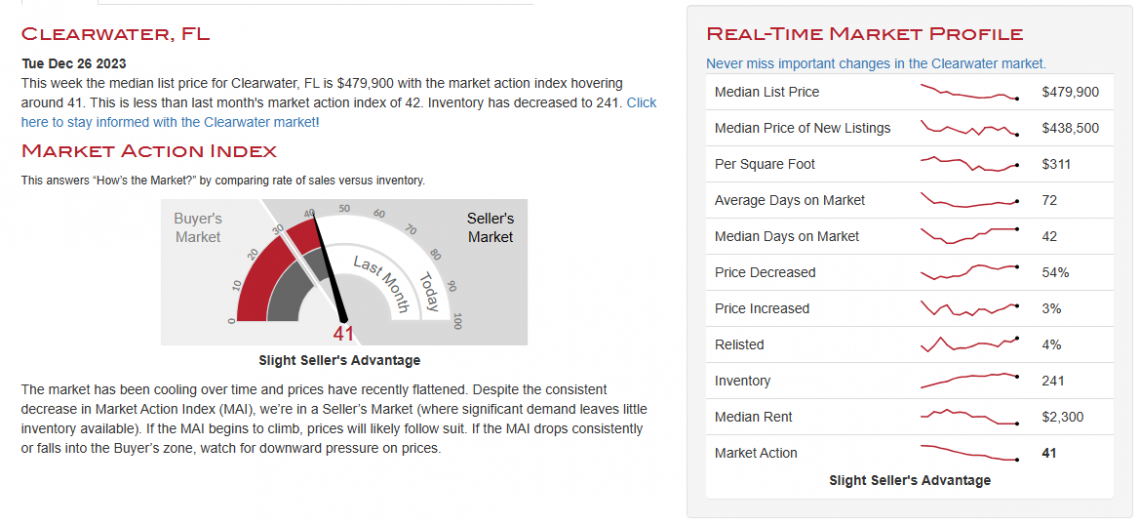

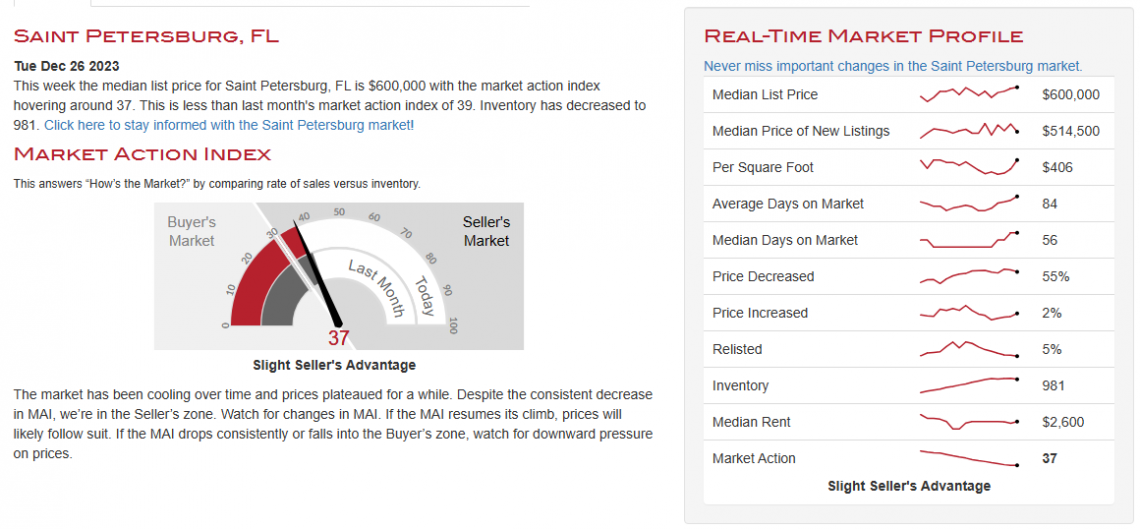

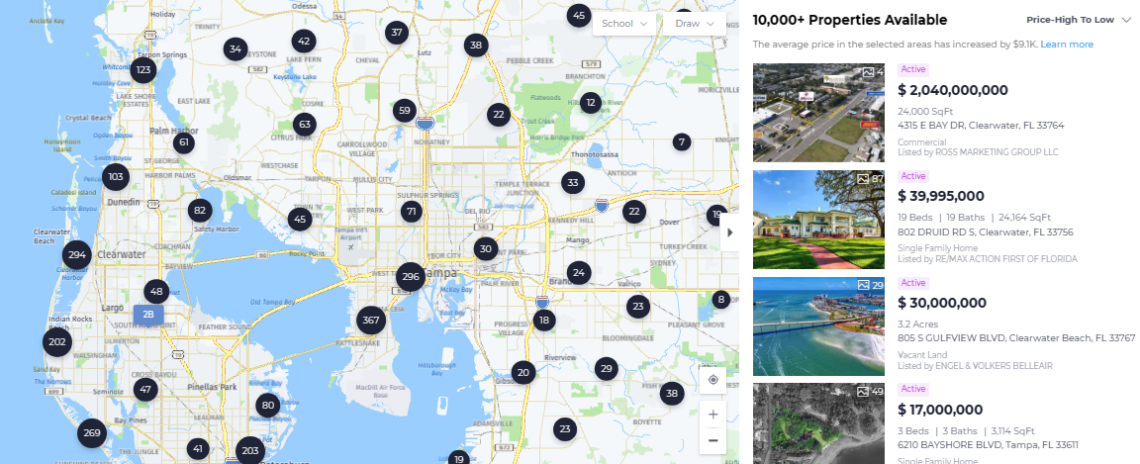

📊 Our Current Local Market Numbers

The Pinellas County housing market has very low inventory that is driving high competition:

➡️ Homes in Pinellas spent about 22 days on the market in June compared to 8 days in June of last year.

➡️ The median sale price of a home in Pinellas County was $392K in June, down 0.76% since June last year.

➡️ There were 1,807 homes sold in June this year, down from 1,952 last year.

The bottom line: Homes may be taking slightly longer to sell than last year, but we are still in a seller's market.

The higher interest rates have slowed things slightly, but also created very low inventory so competition among buyers remains high.

You’ll need a strong offer to purchase a home in these conditions.

We’re staying on top of the market daily and there are even financing options that help you purchase at a lower rate.

If you ever have questions, don’t hesitate to ask.

🏠 Find Available Homes Today

- Available Homes in Palm Harbor

- Available Homes in Tarpon Springs

- Available Homes in East Lake

- Available Homes in Odessa

- Available Homes in Westchase

- Available Homes in Oldsmar

- Available Homes in Safety Harbor

- Available Homes in Dunedin

- Available Homes in Clearwater

- Available Homes on the Beaches or Intercoastal

- Available Homes on a Golf Course

- All Available Homes

📰 In Other News:

- That’s all for today, We hope you have an amazing week!

If there’s ever anything you need:

- Custom market or home value report.

- Home Services list for a reliable contractor or services professional.

- Feedback or a professional opinion on a home project or other needs of the home.

Just let us know! We’re here to help with all your home needs.

Talk soon,