🤔 Ybor Harbor Transformation, St. Pete Luxury Views & Refinancing Your Mortgage

🌊 Ybor Harbor Set to Transform the Waterfront

Driving the news: Ybor Harbor, Darryl Shaw's waterfront vision for downtown Tampa, has received preliminary approval from the Tampa City Council.

The council approved a comprehensive plan amendment and rezoning request to make way for the development.

Details: Ybor Harbor spans approximately 33 acres south of Adamo Drive, east of Channelside Drive, and west of North 19th Street on the Ybor Channel.

The property was once considered as a potential site for a Tampa Bay Rays stadium, but Shaw's plans do not include a baseball stadium.

The plans include:

- 500,000 square feet of office space

- 800 hotel rooms

- Over 150,000 square feet of street-level retail space

- 4,750 new residential units, with 10% dedicated to affordable housing

Why it matters: The approval marks a significant step forward for Shaw's vision of creating interconnected neighborhoods that balance the growing demand for goods through Port Tampa Bay with the desire for walkable, transit-oriented development and access to the waterfront.

The big picture: Ybor Harbor is part of a larger effort to transform Tampa's waterfront, with Shaw also partnering with Washington, D.C.-based Kettler to develop Gasworx, a mixed-use development under construction just west of Ybor Harbor.

What's next: A second hearing on the project will be held on May 2.

Shaw and his team will continue to work with Port Tampa Bay to open the waterfront and create a public space featuring a boardwalk, restaurants, retailers, piers, boat slips, floating docks, and green space.

The bottom line: Ybor Harbor's preliminary approval marks a significant milestone in Darryl Shaw's vision for transforming Tampa's waterfront, creating a mixed-use, transit-oriented community that balances the needs of the growing population with the importance of the maritime industry.

🏠 Explore Spacious Living for $539,000 in

Saint Petersburg, FL

🌇 Luxury Condo Tower in St. Pete Reaches

$65M in Sales

Driving the news: Reflection, an 18-story condominium tower under construction near Mirror Lake in downtown St. Petersburg, has reached $65 million in sales, with $5 million secured in the past two weeks.

Details: The project developed by HP Capital Group is situated at 777 Third Ave. N. It will feature a tower with 88 units offering views of Mirror Lake, downtown St. Petersburg, and Tampa Bay.

Reflection provides eight open floor plan options, with sizes ranging from 1,168 to 2,297 square feet. The pricing for the units starts in the $700,000s, while the penthouses begin at $2 million.

The rooftop is expected to have 12,000 square feet of amenities for residents.

The building will include ground-floor retail space and will be constructed on a six-floor podium. Parking is available from the second to the sixth floor, with residences beginning on the seventh floor.

Why it matters: The strong sales performance of Reflection demonstrates the continued demand for high-end residential properties in the growing downtown St. Petersburg area.

Between the lines: The inclusion of private, expansive lawn terraces with pedestal pavers and artificial turf on the seventh level, as well as the 12,000-square-foot amenity rooftop, suggests that Reflection is targeting luxury buyers seeking high-end finishes and amenities.

What's next: Construction reached its highest point in September 2023 and is close to completion, with residents anticipated to move in this summer.

As construction wraps up, an international artist will create a mural on the building, adding to its visual appeal and unique character.

The bottom line: Reflection's strong sales performance and luxurious offerings indicate a thriving market for upscale residential properties in downtown St. Petersburg, as the area continues to attract buyers seeking a high-quality urban lifestyle.

🤔 Should You Refinance Your Mortgage in 2024? How to Know if it’s Worth It:

Driving the news: Interest rates have been on a roller coaster ride since 2020, with the Federal Reserve's actions significantly impacting mortgage rates.

There is a possibility that the Fed may cut interest rates later this year, presenting potential advantages for recent homebuyers considering a rate and term refinance.

Details: In January 2021, the 30-year fixed mortgage rate hit a record low of 2.65%, but as the Fed combatted inflation, rates increased, currently ranging between ~7% and ~8%.

When rates start to dip, many homeowners ask themselves: "Should we refinance?" This decision is particularly relevant for those who purchased homes at peak rates.

When to consider refinancing: These are some scenarios where you should look at your loan and consider refinancing:

- Lower Interest Rates: Consider refinancing if mortgage rates have decreased significantly since you took out your original loan. A rule of thumb is to refinance when you can lower your interest rate by at least 0.75 to 1 percentage point.

- An increase in income: If you find yourself making more money, refinancing to a shorter-term loan, like switching from a 30-year to a 15-year mortgage, can save you money in the long run. This usually increases your monthly payments but significantly reduces the total interest paid over the life of the loan.

- Improved Credit Score: If your credit score has improved since you first secured your mortgage, you might qualify for a lower interest rate. Lenders offer better rates to borrowers with higher credit scores, as they pose a lower risk.

- Removing Mortgage Insurance: Refinancing can also help you eliminate the need for mortgage insurance. This is particularly relevant if you have built up sufficient equity in your home (typically 20% or more).

- Tapping into Home Equity: A cash-out refinance allows you to access the equity you've built up in your home, which can be used for various purposes like debt consolidation, home improvements, or other significant expenses.

You should always consider the closing costs of refinancing and calculate the break-even point — the time it takes for the monthly savings from the new mortgage to outweigh the refinancing costs. This analysis will help you determine if refinancing is financially worthwhile.

Why it matters: Refinancing can lead to significant financial benefits, such as lower monthly payments, faster mortgage payoff, and access to home equity.

What’s next: Those who purchased homes at higher rates should watch for rate drops and consider the scenarios above to see if refinancing makes sense for them.

The bottom line: The decision to refinance a mortgage in 2024 hinges on a complex interplay of interest rates, individual financial situations, and market trends.

Homeowners should stay informed and consult with financial experts to make a plan suited for them.

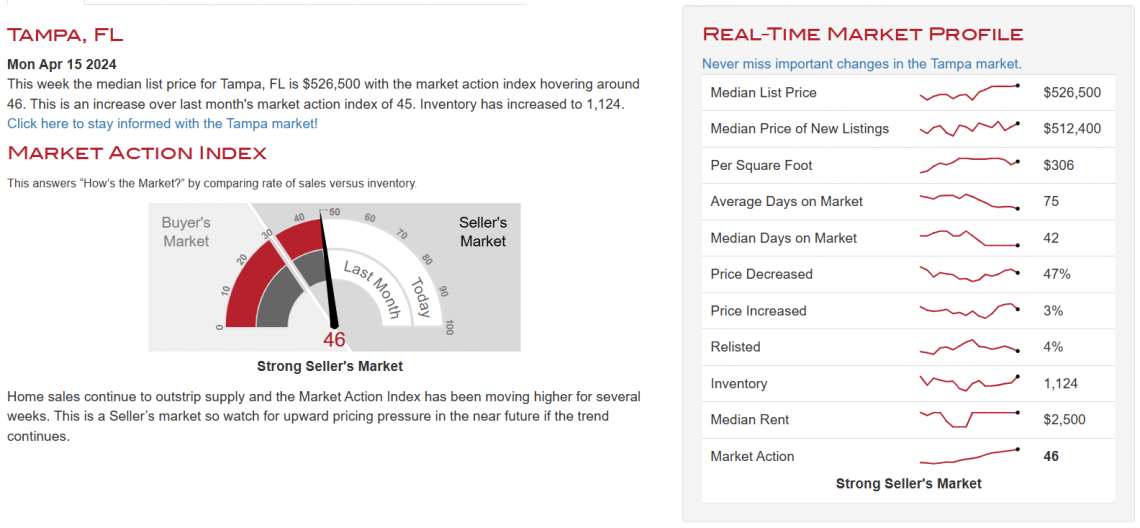

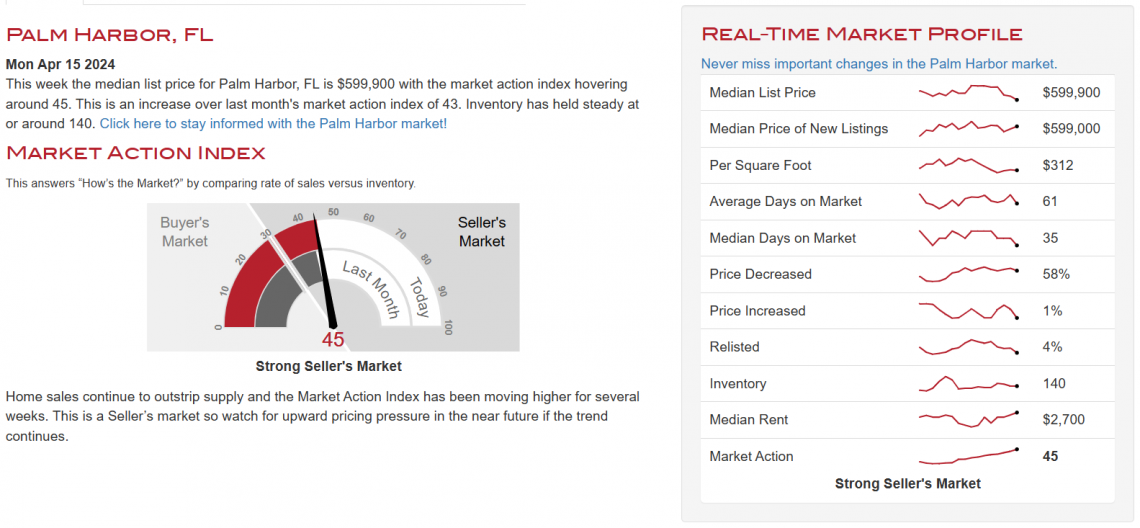

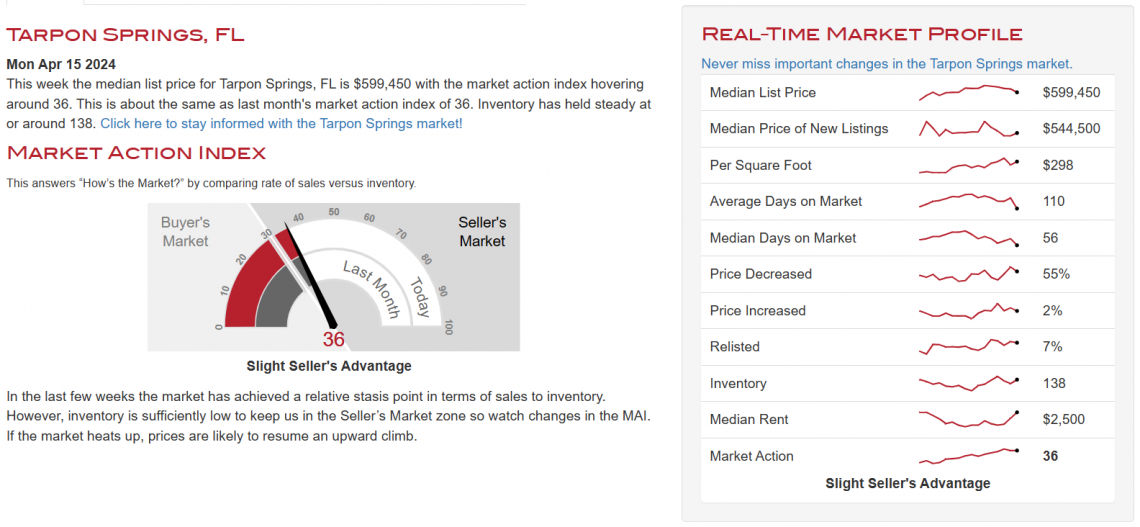

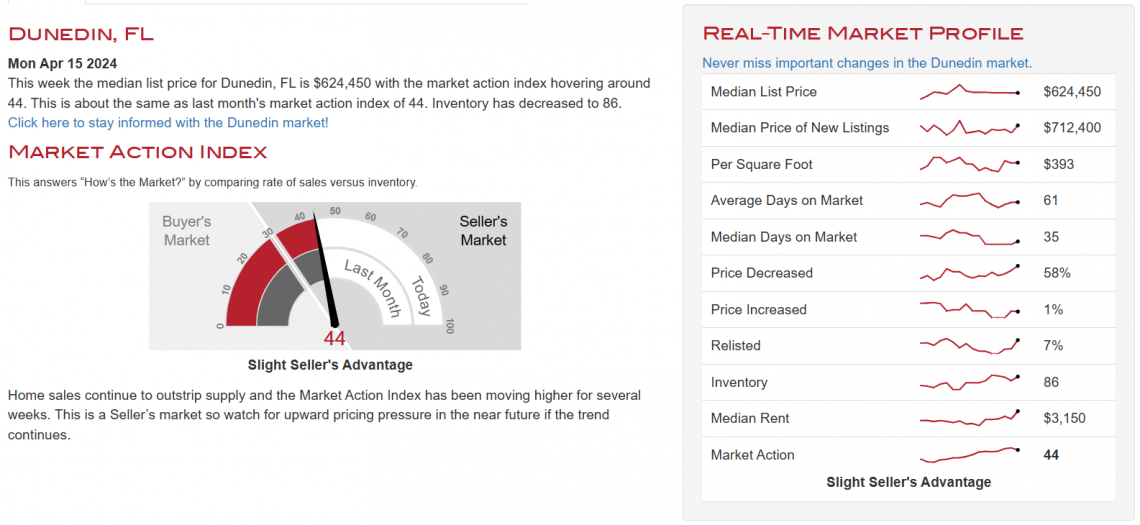

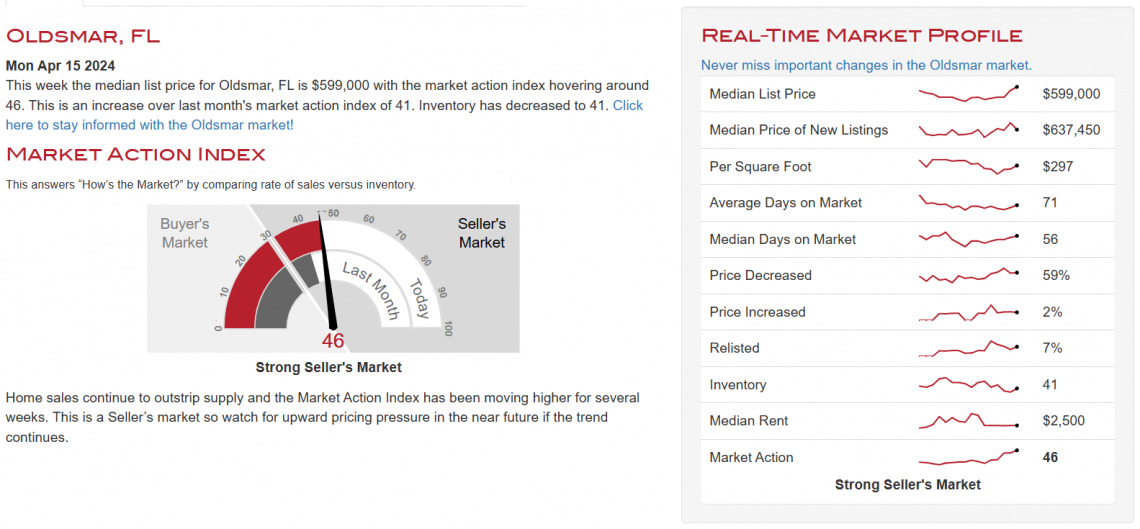

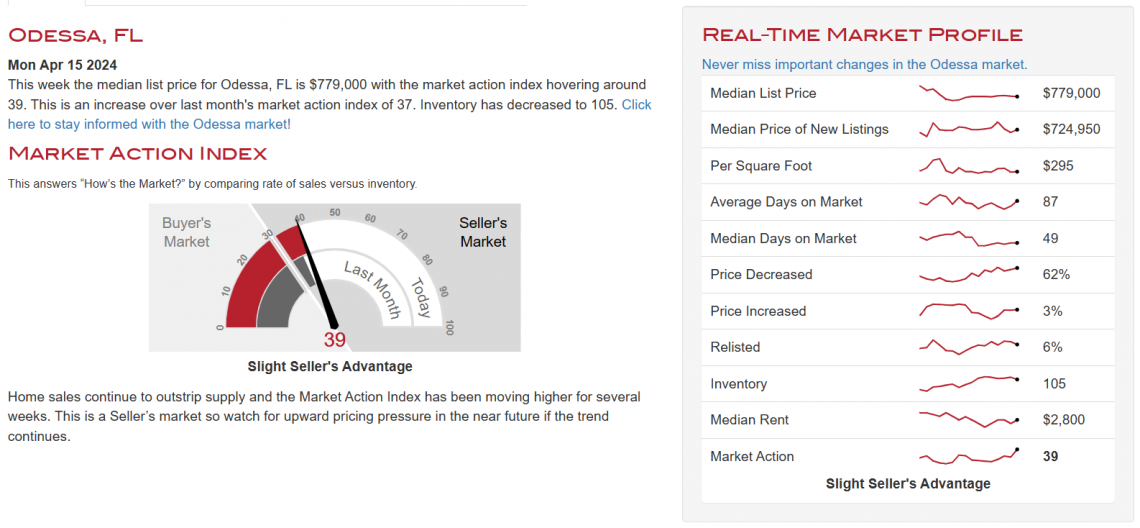

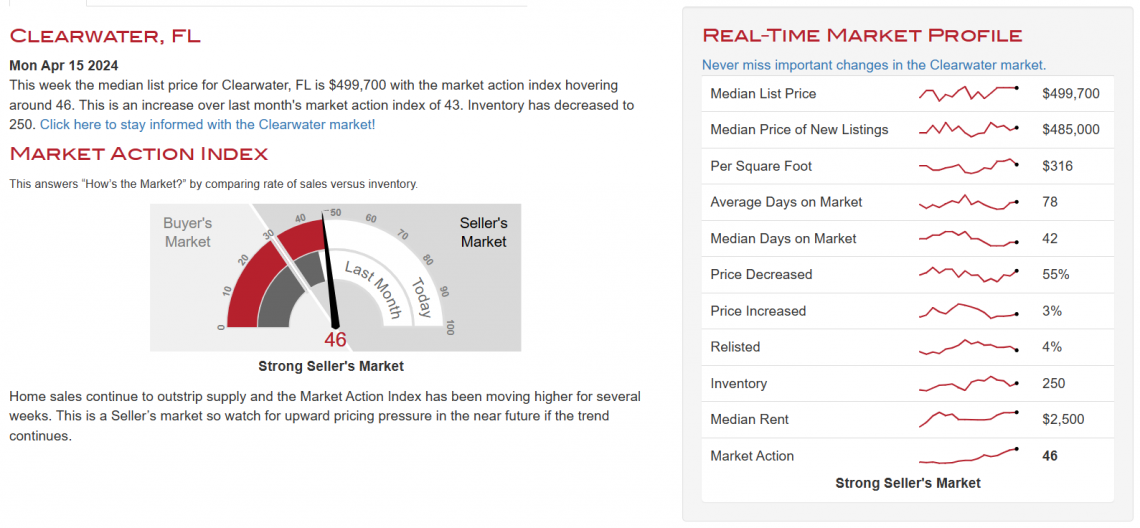

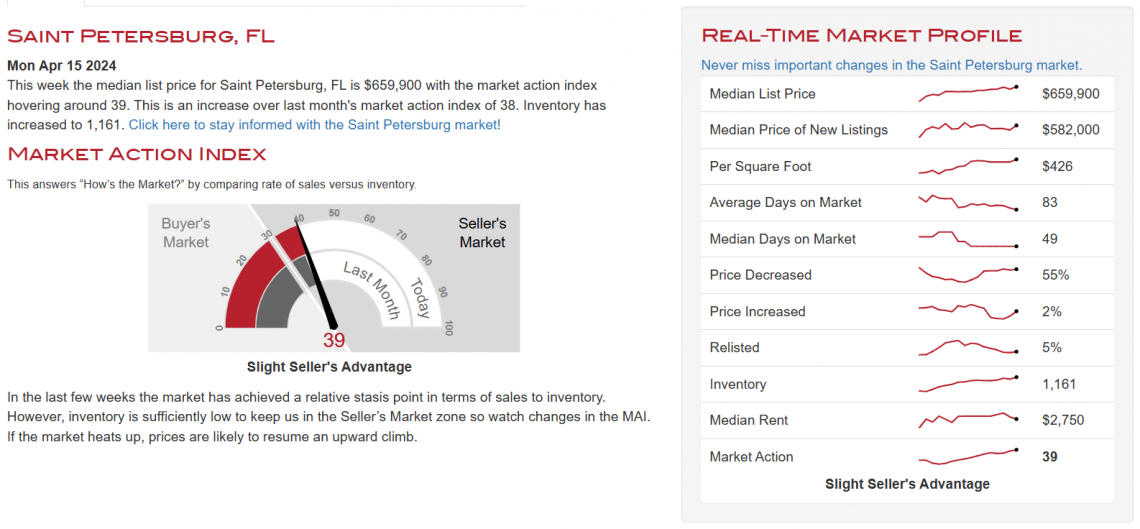

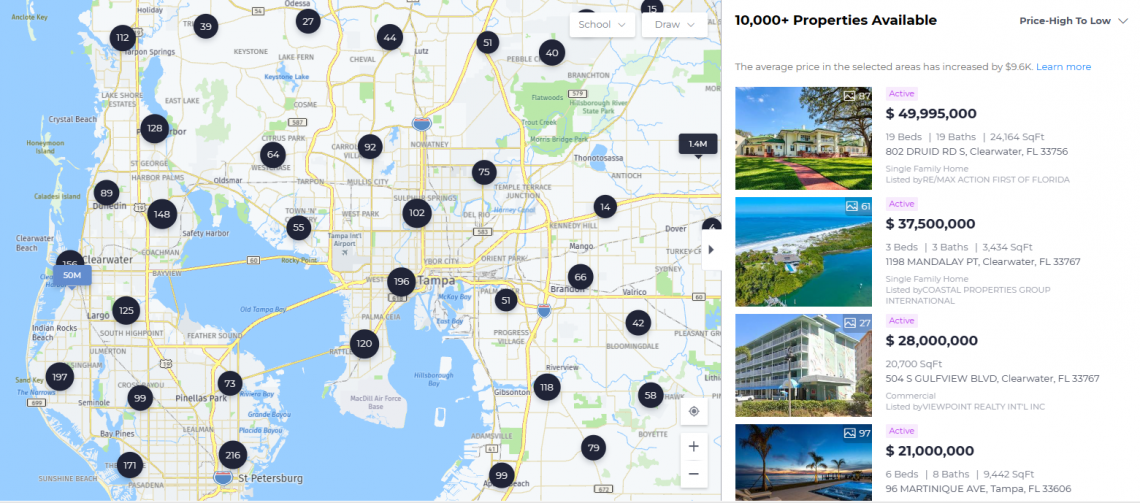

📊 Our Current Local Market Numbers

The Pinellas and Tampa Bay markets are heating up as we get closer to spring.

If you are looking to buy or sell a home in the next few months, you'll need a strong strategy to navigate the nuances of this market.

I'm happy to help you create a plan that will allow you to succeed in the current market.

If you ever have questions, don’t hesitate to ask.

🏠 Find Available Homes Today

- Available Homes in Palm Harbor

- Available Homes in Tarpon Springs

- Available Homes in East Lake

- Available Homes in Odessa

- Available Homes in Westchase

- Available Homes in Oldsmar

- Available Homes in Safety Harbor

- Available Homes in Dunedin

- Available Homes in Clearwater

- Available Homes on the Beaches or Intercoastal

- Available Homes on a Golf Course

- All Available Homes

📰 In Other News:

- That’s all for today, We hope you have an amazing week!

If there’s ever anything you need:

- Custom market or home value report.

- Home Services list for a reliable contractor or services professional.

- Feedback or a professional opinion on a home project or other needs of the home.

Just let us know! We’re here to help with all your home needs.

Talk soon,